At BF Money, we value relationships.

We take a personal approach to property finance and we don’t take a ‘one size fits all’ approach. We don’t simply take your application and feed it into a system or software, because we know the numbers are rarely a true reflection of your circumstances or your success. And software alone can’t give you guidance, or advice. As much as financial ratio’s and spreadsheets are important, ultimately, it is still people that make decisions and provide service. We take the time to understand your circumstances and to tell your story to the people inside the lenders that can help… directly.

So, we are very excited to be hosting a series of events this year to bring the best of the lenders to you. Some will be with Bank’s and other lenders, while others are with leading industry experts from multiple disciplines, each designed to add value to your business.

We connect you not just with the best loan products, but with the best of the industry.

St George Bank Property Panel Discussion

We are excited to be kicking off the event series with St George Bank at the Parkroyal Hotel in Parramatta, where we will be joined by the influencer’s within the Bank.

Our association with St George’s property team started in 2002, and in 2006 BF Money piloted the commercial introducer program. Since then, we have regularly been St George’s largest commercial finance broker and our client’s enjoy the benefits of these relationships.

We are very excited to be introducing you to some very influential people at the Bank and to take your questions in a panel discussion.

Those people that work on your transactions, both in the back office, and the front office, but also some senior people that influence policy and decisions that affect your business. In addition to various front line staff, we will have an elite panel from St George Bank to take your questions.

This is a very exclusive event for BF Money clients who have facilities with St George Bank and is not open to the general public. If you have not received an invitation but would like to be considered, please email us directly and register your interest. Light refreshments and drinks will be served to promote informal discussion and networking.

Join us for a not to be missed presentation and panel discussion to answer your questions on the important topics of:

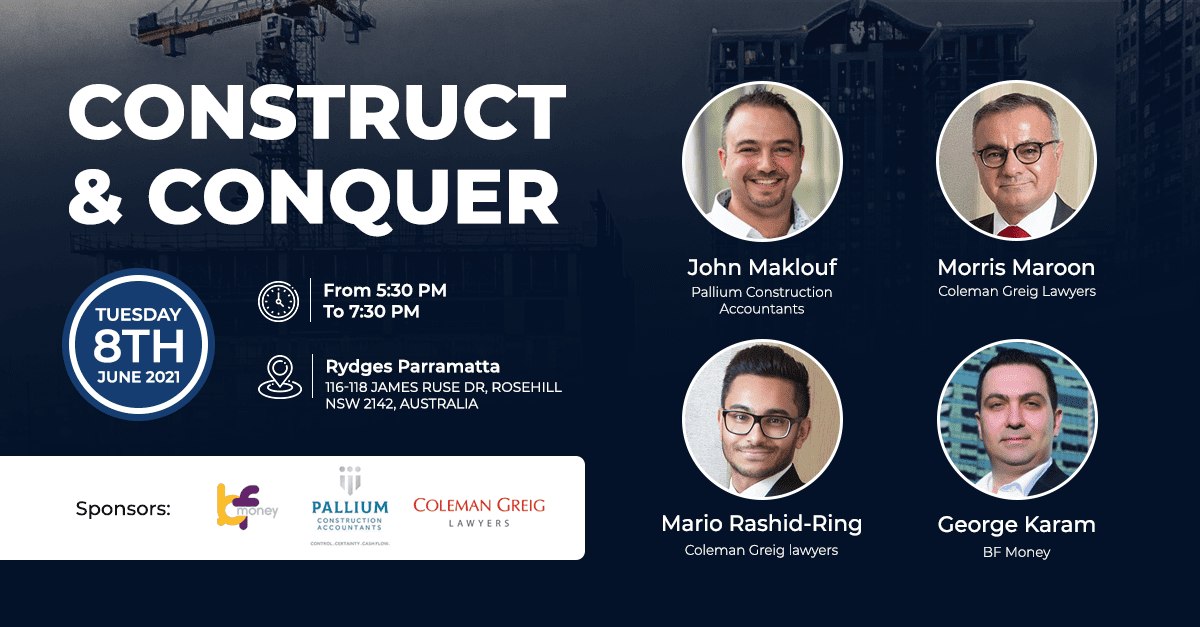

Development Management Agreements

&

Joint Ventures

We will be discussing the tax, legal and finance implications of these important concepts and how best to ensure you minimise risk and tax when using them correctly.

This event is FREE for BF Money clients who will receive a promotional code and instructions on how to obtain free tickets in a separate communication.

Tickets are $99 and include buffet dinner, parking and drinks

Friday 18th June 2021

NAB Clients Save the Date

Similar to the event event with St George Bank, we are bringing you an event with the best of National Australia Bank. Details will follow and we are very excited to reveal the details of this event but for fear of too much excitement all in one email, we’ll leave something to talk about next time…

MFAA Excellence Awards

State Finalist

Commercial Finance Broker 2021

Thanks to our wonderful clients and engaged Lenders, I am delighted that BF Money has once again been nominated as a finalist for the MFAA’s (Mortgage and Finance Association of Australia) Commercial Broker of the Year Award for 2021 for NSW/ACT.

In 2020 we were awarded as both the State and National Winner and in 2021 we are hoping to retain our title!

This award is a great acknowledgement of the tireless efforts and passion of our entire team who have rallied behind our purpose to deliver tailored solutions, expertly delivered, that enrich lives and businesses.